Everything about Amur Capital Management Corporation

Everything about Amur Capital Management Corporation

Blog Article

The Best Strategy To Use For Amur Capital Management Corporation

Table of ContentsGet This Report about Amur Capital Management CorporationWhat Does Amur Capital Management Corporation Mean?Examine This Report about Amur Capital Management Corporation4 Easy Facts About Amur Capital Management Corporation ShownThe Single Strategy To Use For Amur Capital Management CorporationAmur Capital Management Corporation - The FactsThe Main Principles Of Amur Capital Management Corporation

A reduced P/E ratio may show that a company is underestimated, or that capitalists anticipate the firm to encounter much more difficult times in advance. Capitalists can make use of the ordinary P/E ratio of other companies in the same industry to develop a standard.

Everything about Amur Capital Management Corporation

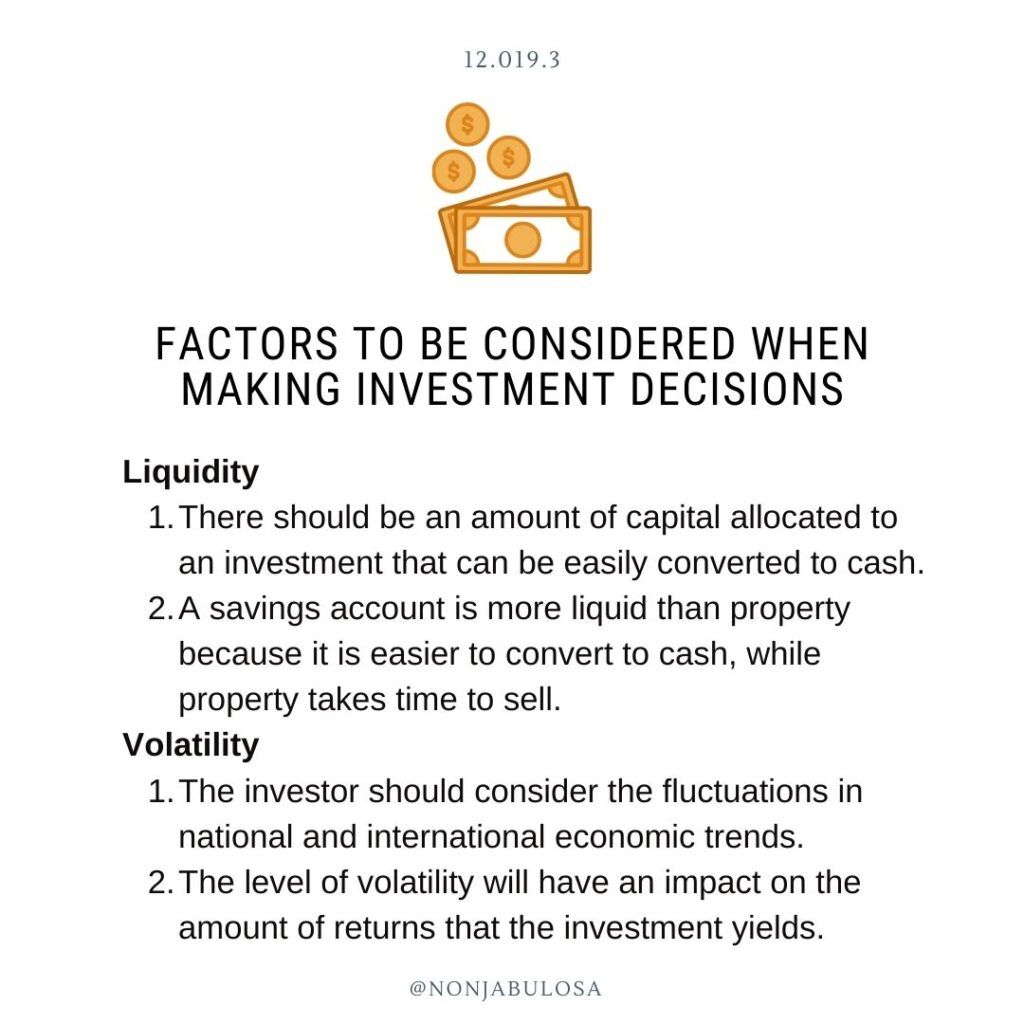

A supply's P/E ratio is very easy to find on most economic reporting internet sites. This number shows the volatility of a supply in comparison to the market as a whole.

A supply with a beta of above 1 is theoretically a lot more unpredictable than the marketplace. For instance, a security with a beta of 1.3 is 30% even more unstable than the market. If the S&P 500 increases 5%, a supply with a beta of 1. https://www.giantbomb.com/profile/amurcapitalmc/.3 can be expected to increase by 8%

Not known Factual Statements About Amur Capital Management Corporation

EPS is a buck figure standing for the section of a company's revenues, after tax obligations and participating preferred stock returns, that is designated per share of common supply. Financiers can utilize this number to evaluate exactly how well a business can deliver value to shareholders. A greater EPS results in greater share costs.

If a business routinely falls short to supply on revenues forecasts, an investor might wish to reassess purchasing the supply - alternative investment. The calculation is straightforward. If a business has a take-home pay of $40 million and pays $4 million in returns, then the continuing to be amount of $36 million is split by the number of shares superior

What Does Amur Capital Management Corporation Mean?

Capitalists commonly obtain interested in a stock after reading headings about its sensational performance. Simply keep in mind, that's the other day's news. Or, as the investing sales brochures constantly expression it, "Past performance is not a predictor of future returns." Audio investing decisions need to think about context. An appearance at the fad in rates over the previous 52 weeks at the least is necessary to obtain a feeling of where a supply's price might go next.

Allow's check out what these terms imply, how they vary and which one is finest for the typical financier. Technical experts comb through massive volumes of data in an effort to anticipate the instructions of stock prices. The data consists primarily of previous pricing info and trading quantity. Fundamental analysis fits the demands of a lot of capitalists and has the advantage of making great sense in the real life.

They think prices adhere to a pattern, and if they can understand the pattern they can exploit on it with well-timed trades. In recent years, modern technology has actually made it possible for more investors to practice this style of spending due to the fact that the tools and the information are much more easily accessible than ever. Basic experts take into consideration the intrinsic value of a supply.

Some Of Amur Capital Management Corporation

Much of the concepts went over throughout this item prevail in the fundamental analyst's world. Technical analysis is finest fit to a person that has the moment and comfort level with data to put limitless numbers to use. Otherwise, essential evaluation will certainly fit the demands of most capitalists, and it has the benefit of making great sense in the real life.

Brokerage firm costs and common fund cost proportions pull cash from your portfolio. Those expenditures cost you today and in the future. For instance, over a period of twenty years, annual fees of 0.50% on a $100,000 financial investment will reduce the profile's value by $10,000. Over the same duration, a 1% charge will decrease the exact same portfolio by $30,000.

The trend is with you (https://www.quora.com/profile/Christopher-Baker-668). Take benefit of the trend and shop around for the least expensive price.

Amur Capital Management Corporation Can Be Fun For Everyone

, environment-friendly area, picturesque views, and the community's standing element plainly into residential building assessments. An essential when considering home location is the mid-to-long-term view relating to just how the area is expected to progress over the financial investment duration.

How Amur Capital Management Corporation can Save You Time, Stress, and Money.

Completely review the ownership Check Out Your URL and designated use of the prompt locations where you plan to invest. One method to accumulate details about the potential customers of the location of the home you are taking into consideration is to contact the city center or various other public firms accountable of zoning and metropolitan planning.

This offers regular revenue and long-lasting value gratitude. This is typically for quick, small to tool profitthe typical property is under building and marketed at a revenue on conclusion.

Report this page